How do I view or download my invoices?

You can view, print, and email invoices from your account for presenting copies to your accounting department or for year-end tax calculations. Account owners and admins can view Typeform invoices.

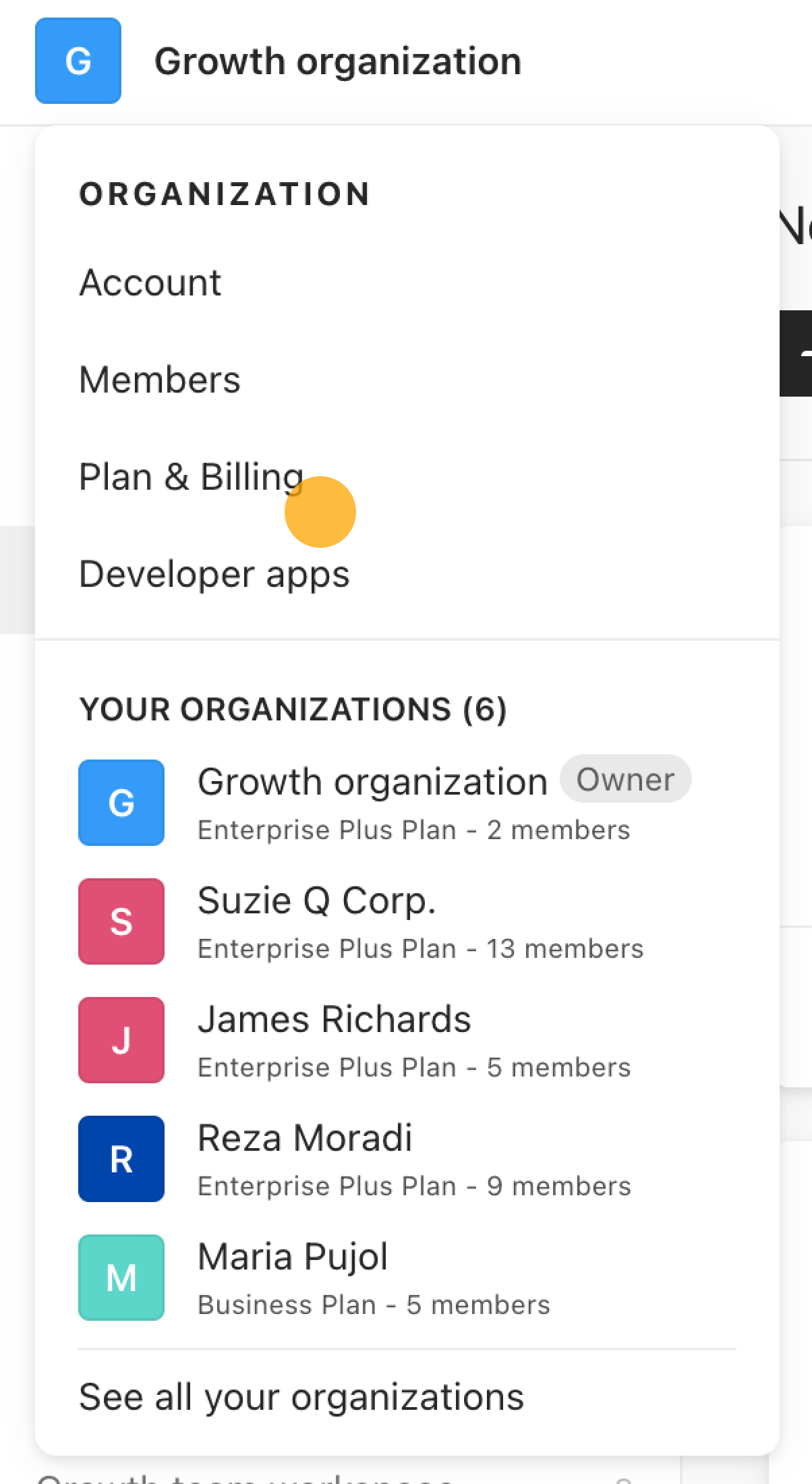

1. Log in to your Typeform account and click on the top left hand corner to see your organization menu. Click Plan & Billing:

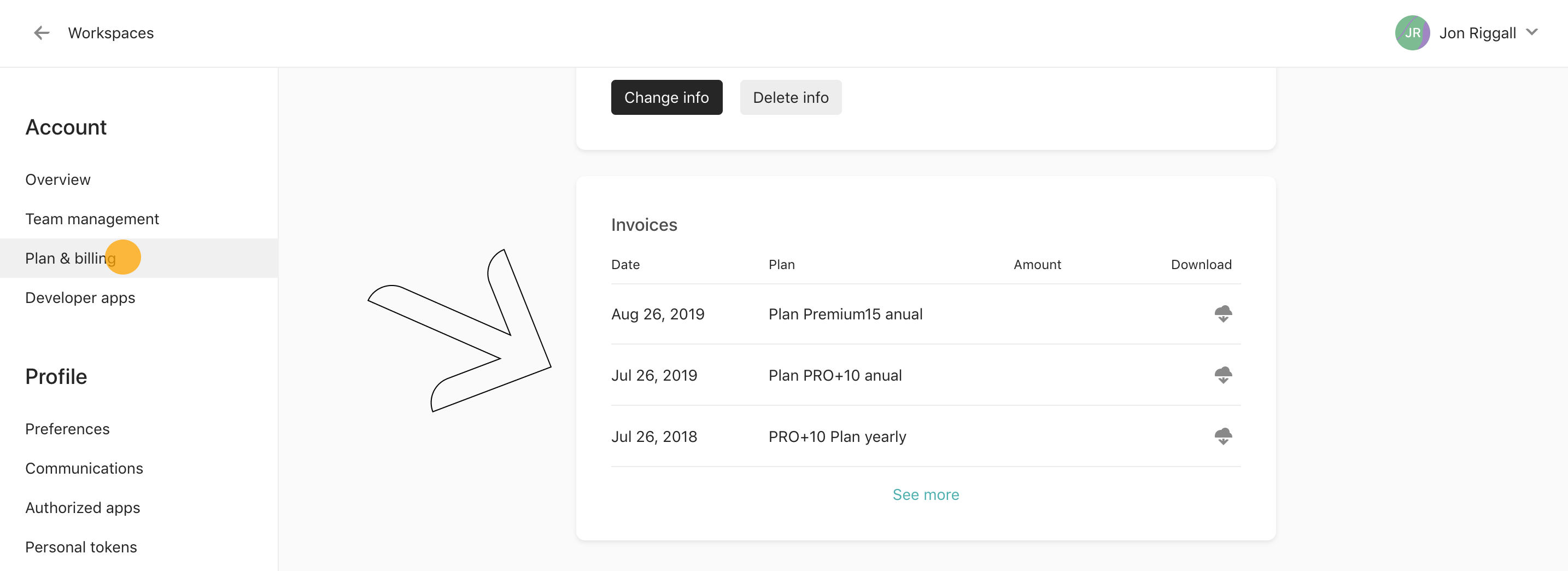

2. On the Plan & billing page, scroll down until you see the Invoices panel:

3. Click on any of the visible download icons to see a complete invoice. To view your complete invoice history, click See more.

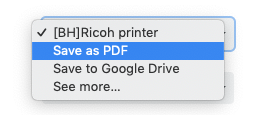

Invoices will open up in a new window of your browser, and you can save or download them as a PDF from there. To do this, use the CMD/CTRL + P keys to open your browser's Print menu, then click Save as PDF, followed by Save:

This menu may look different depending on your browser you use, but the print menu should present a destination option to Save as PDF.

You can then choose the destination folder for your PDF.

Can I edit my invoice details?

We are not able to amend an invoice which has already been issued. You can edit your payment details under Plan & Billing in your Typeform settings. Once you've updated your information, all future invoices will be issued with your last amendments.

Can I add a second email for invoices to be sent to?

Invoices can only be sent to the email address associated with the Typeform account. Currently, we cannot send invoices to a second email address. If you'd like to change the email address associated with your account, you can do so in Settings - for more information, check out this article.

Can I add VAT to my invoice?

We cannot amend invoices already issued. Therefore, you need to make sure to add all your billing details correctly before hitting the payment button. VAT can be added after selecting your country in the VAT number/Tax ID field - find this by editing your Payment details.

Once you've entered a valid VAT number, this will be deducted from the final price on your next invoice.

Note! We accept VAT numbers from EU countries only.

Have another billing-related question? Check out our Billing & Payments FAQ.