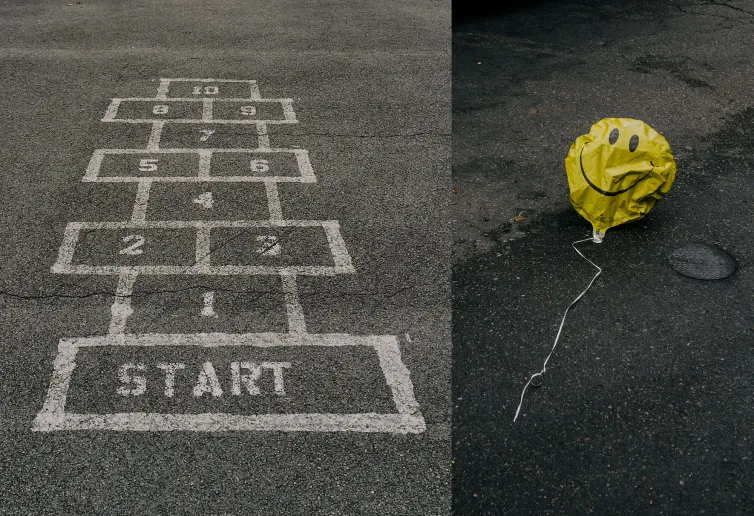

When I first joined Typeform a few years ago, we were a small startup. But we were also big enough to receive huge amounts of data from our customers through support conversations. The feedback was valuable and we needed to share it with the rest of the company.

Also critical was finding ways to take all of our customer feedback and turn it into a structured an automated approach. That’s when Angela Guedes decided to create Typeform’s first Voice of the Customer (VOC) report. Though not without its complexity, as Angela recalls, it was well worth the effort to get to where we are today.

“The VOC solved all of our challenges. We combined data from support tickets, surveys, and customer calls and constructed our story. We could also track the impact caused by a fixed pain point or a new release.”

Creating a VOC presentation that pulled together all of our company feedback helped us better understand customer retention, revenue growth, and churn. It also shined a spotlight on the Customer Success team and our role in making this happen.

Take a peek at how our Customer Success team worked back then.

The making of a VOC prototype

So how exactly did we initiate the VOC process? We started by creating a tagging system to help track and classify those conversations into labeled categories, so we could then filter and identify patterns. Later on, we implemented the Net Promoter Score (NPS) and Churn surveys to collect feedback at different stages of the customer journey.

Naturally, there were some initial challenges:

Segmentation. We successfully aggregated different sources of information, but had no insight into who our customers were, or what they were doing with Typeform. Not having diverse profiles made it difficult for our Product team to implement viable solutions that could adapt to our customers’ jobs-to-be-done.

Strategic focus. Since we didn’t know who our customers were, we didn’t have a clear strategy for which insights to act on first, or how to move forward prioritizing other VOC insights.

Channel expansion. We hadn’t figured out a way to collect data from our customers on social media in a way that was structured or automated.

Over the years, we’ve made several tweaks to our VOC program—and we'll probably continue making changes to best fit company needs. But this isn’t about what we’ll do tomorrow, but rather a deep dive into how we solved our challenges today and what works for us.

Here’s a guide to help you kickstart your own Voice of the Customer process.

Listen: Where is your feedback coming from?

Let’s start by understanding the type of data you’d gather when implementing a VOC program. Gartner classifies it with the three following feedback types:

Direct—solicited: Here, the customer shares their feedback directly with you. Typically, this comes from surveys, market research, or panels where customers share their opinions and experiences about your product or service.

Indirect—unsolicited: This is insight into what customers are saying about you without their being directly asked to provide this data. Indirect feedback includes social listening, customer support, website reviews, or forums.

Inferred—observed: It’s what your customers actually do. You can track different actions on how the customer interacts with your business, and then connect data points such as web clickstream, help center navigation, search results or purchase history to predict consumer behavior and uncover new insights.

Of these, soliciting direct feedback, such as surveys, is a good starting point for understanding customers’ main pains and needs along their journey with your company. Combined with other data sources—such as social media comments, third party review sites, or customer support tickets—it can also lead to deeper insights and a more actionable VOC report.

At Typeform, we’re running these surveys on an ongoing basis for all of our users at different stages. Here are some of the conversational forms and surveys we use:

Signup form

When a user first arrives at Typeform.com, we ask them a couple of questions:

What’s your first name?

Hello, [first name]. What’s the main thing you’ll be using Typeform for?

What's the one main activity you want to do with Typeform?

Which of these best describes your role?

And how did you first discover Typeform?

Knowing a person's goals not only helps us segment our data later on, it also helps us to personalize their experience based on their preferences.

Satisfaction survey

At the end of every quarter, we send out an email to all our customers who have been active for more than three months to ask for feedback.

In these comms, we also mention new changes we’ve made to our product, thanks to user feedback provided in the previous quarter. This is how we show appreciation for our users' time and encourage them to keep sharing their thoughts with us.

This survey includes the standard NPS [How likely are you to recommend Typeform to a friend or colleague?] and CSAT [Overall, how satisfied are you with Typeform?] questions, along with other questions around a users' satisfaction and expectations about our product and support services. This provides a recurrent checkpoint for us to know where we are and how we can continue to do better.

You can click through one version of it here:

Customer effort score (CES)

After a support ticket is closed, we send a follow-up email asking: "Overall, how easy was it to get the help you wanted?"

This typeform survey is embedded in an email, so once they click on one of the emojis, the full typeform pops up with a follow-up question asking for further details.

Churn survey

Understanding why our customers are canceling their subscription is valuable to us, because it’s an indicator of ways we can improve our product and overall customer experience.

Our churn survey is embedded directly on the screen users access to cancel their subscription. After selecting their reason for cancellation, they’re prompted with an open text question. The more we know about why our customers leave, the higher the chances we’ll know how to make them stay.

You can have a look through it here:

NPS (Net Promoter Score), CES (Customer Effort Score) and CSAT (Customer Satisfaction Score) can help you measure customer satisfaction and loyalty. And while those are useful scores to track over time (often used as key customer success KPIs), it won’t give you enough detail to define actions. Their feedback channels and additional research are key.

Listening to unsolicited feedback sources provides a holistic picture of our customers' needs.

At Typeform, we use different tools to collect this type of feedback. In most of the cases, this information is connected to our database so that we can manipulate and combine all of the user data for our relevant insights. Here’s where we focus our sights.

Support tickets and chat

This source of feedback is a gem, considering these are the customers who contacted you because they couldn’t figure out how to do something themselves. This gives you a better understanding of customer pain points, be aware of bugs, listen to features suggestions and allow the customer to discover things they were not aware they could actually do with your product.

Our tagging system was built in Zendesk which allows us to track the main themes of our support interactions over time. Our support agents then add different tags based on the conversation they had with a customer.

To create this taxonomy, we started by identifying what we wanted to answer and which were our business problems. Then we worked backwards to start creating our tagging structure.

Here’s an example of our high-level categorization, which breaks down into specific product features:

Feature request - Refers to anything that is currently not part of our product or its capabilities. This categorization helps us understand what our customers want to achieve with our tool. It also helps us understand how we can improve.

Unaware - Refers to the features customers don’t know exist. For example, a customer might ask ‘How can I skip questions in a form?’ They don’t know they can use Logic Jumps. Combining this tag with product areas helps us identify features that are not easy to find and create improvement actions for UX and Education teams to make those more discoverable.

Bug or issues - Tracking bugs or downtimes in support tickets help us understand the impact it has on customers and to estimate how many have been affected by the problem.

Billing - Understanding payment pain points is key to creating a smooth and intuitive payment process. We tag user questions related to pricing, invoices, refunds or subscriptions.

This overall structure does not change over time, but we are constantly reviewing the categories and adapting the labels to new product features and company needs.

Social media

People talk about you and your competitors constantly. Although it’s hard to measure and quantify those messages, a monitoring tool helps keep track of this data and can help uncover opportunities. At Typeform, we’ve recently started using Brandwatch to analyze customer conversations online. Now we can analyze sentiment, discover trending topics or find out which brand messages sparked the most interest in our social media channels overtime.

1:1 conversations from Sales and CSM

One on one conversations can help understand problems identified from other sources with a real customer story and bring more context to your data.

Most common issues from Sales or Enterprise customers (CSM) differ from that of an average user. This helps us uncover new opportunities for our diverse customer profiles.

For that reason, it’s important to use the same taxonomy in every team (Support, Sales, CSM) to keep consistency in the way we track unstructured data and segment feedback from different sources.

Now we know how and where to collect feedback for the voice of the customer analysis. The next—and most challenging step— is how to turn that voice into insights that will help drive the entire company.

Identify and prioritize relevant insights

Making strong business decisions can be challenging when gathering huge amounts of data. You need to identify what’s relevant, and transform all this data from different sources into a single pack of actionable insights.

Let's fly over the structure that works for Typeform today.

Big picture: Overview of the main KPIs

It’s important to implement the VOC on a recurrent basis to be able to evaluate trends overtime and see how we are doing, what needs to improve and where to focus our team’s efforts. Without regular reporting, stakeholders won’t be able to act on it and improve our services on an ongoing basis.

To keep track of the main metrics in real-time we’ve created dashboards that anyone can access and self-explore whenever they need. At the same time we do a Customer Voice report at the end of every quarter to help explain the trends and KPIs we see, giving possible explanations to any significant differences compared to the previous quarter:

NPS score overtime

Satisfaction score CSAT

Support ticket topic trends

Sentiment analysis on social media

Churn reasons overtime

Now let’s dig deeper into the main sections: Product and Customer Success feedback

Product Feedback

First you need to identify what burning questions need answering. Here's where we focus:

What are the most popular requests from users? Does it differ by job-to-be-done? Does our Ideal Customer Profile ask for different features than average users?

Where do our customers struggle and how can we help solve their problems?

What are our customers saying about recent feature launches?

Research questions give you focus and direction on how to structure your feedback and start segmenting all your data. The more you combine customer feedback with user and behavioral data, the more chances you have to identify relevant actionable insights.

Let’s look at this data from our Satisfaction Survey. We asked our customers ‘Which of the following areas have you had more difficulties working with?’:

Here we see many users are struggling to set up logic jumps. They also struggle to understand how to optimize their forms. (psst, here's some tips on how you can increase your form submissions, courtesy of our Data team's recent data dive).

But does the graph vary if you segment your customers by their plan, job-to-be-done, or number of days since sign-up?

The key to finding actionable insights is to segment our data and dig deeper to find out what’s really new.

For example, if we segment it by job-to-be-done, we can see that customers using Typeform to collect leads have difficulties understanding how to best optimize their forms. Whereas those creating surveys to collect feedback or do market research need better analytics and visualization capabilities.

BOOM!

Now, if our company's objective is to grow a particular customer segment, we've got an indicator about where we should focus to achieve that goal.

“The VoC lets us check the pulse of our customers’ sentiment relating to our product and features. It also enables us to see how this sentiment varies between different types of customers and use cases which helps our product teams focus on what’s most important.”

Customer Success Feedback

For our Customer Success team these are the questions we are trying to answer:

How satisfied are customers with the interactions with our customer support? How can it be even better?

Which type of educational materials should we promote to help our customers get to value as soon as possible? And which channels do they prefer?

Here’s an example of how we do this.

We asked customers who had recently interacted with our customer support team to rate the following four areas on a scale of 1-7:

As noted on the chart, there was an improvement! Customer service satisfaction increased in all the areas in Q3. But why? What did we do right?

To figure it out, we dug deeper into our data points. In this case, data confirmed our average response time improved month after month.

We also saw the impact of this reflected in the number of mentions for "slow/fast response time" in social media channels:

“The VOC is actionable “gold” which has helped us determine where and how we can make our customer’s journey from sign up through onboarding easier, more seamless, and meaningful.”

Iteration, feedback, and actions from stakeholders

In our final phase, we reach out to key stakeholders: Leadership, Product, and Customer Success teams. Without their buy-in, this report wouldn't make any sense.

We organize this process in two ways:

With a deep analysis of the quarterly VOC

With customer centricity meetings for company alignment

Here's more detail on each:

Deep analysis of the quarterly VOC

The Voice of the Customer report provides a holistic picture of how we’re doing, but in order to understand the issues identified, additional research is key.

Our stakeholders help us decide what to evaluate next: Do we need a deeper understanding of why our customers are churning? Why exactly would we need that feature? How can we really help users get to value as quickly as possible? Should we do a usability test on a specific feature?

At this point, upcoming projects are defined by teams in the organization to understand the user's pain points in more detail and find ways to remedy them.

Customer Centricity meetings for stakeholder alignment

If we want to iterate fast, quarterly reporting just won’t cut it. Instead, we run triweekly meetings with key stakeholders where all researchers at the company present main insights, and the latest findings. In a growing company like Typeform, these meetings help clarify and align objectives.

Òscar Carbonell, our Director of Strategy, says it well:

“Since the moment we created the customer-centricity project, the word customer is not just a word, but rather an entity with feelings, emotions and a face for who all of us at Typeform work hard to solve their problems. ”

Typeform has always focused on the customer and their needs. But knowledge about the customer was spread around the company, and we simply didn't know what we knew. The VOC report changed all of that. Thanks to these new insights, we've been able to double down on our educational content including video channels, in-app assistance, and more tailored content to guide and inspire customers.

We've also been able to apply a tiered support model that speaks to the individual needs of our customers rather than a ‘one size fits all’ methodology. These feedback loops ensure we get to the root cause of issues quickly, and enables innovation as we scale. We hope it does the same for you, too.

Did you find this article informative and interesting? We’d love to hear from you.